Money Buys Efficiency: Investing Tips To Save Time

Strategic spending transforms your day with free training tips to boost savings. Now!

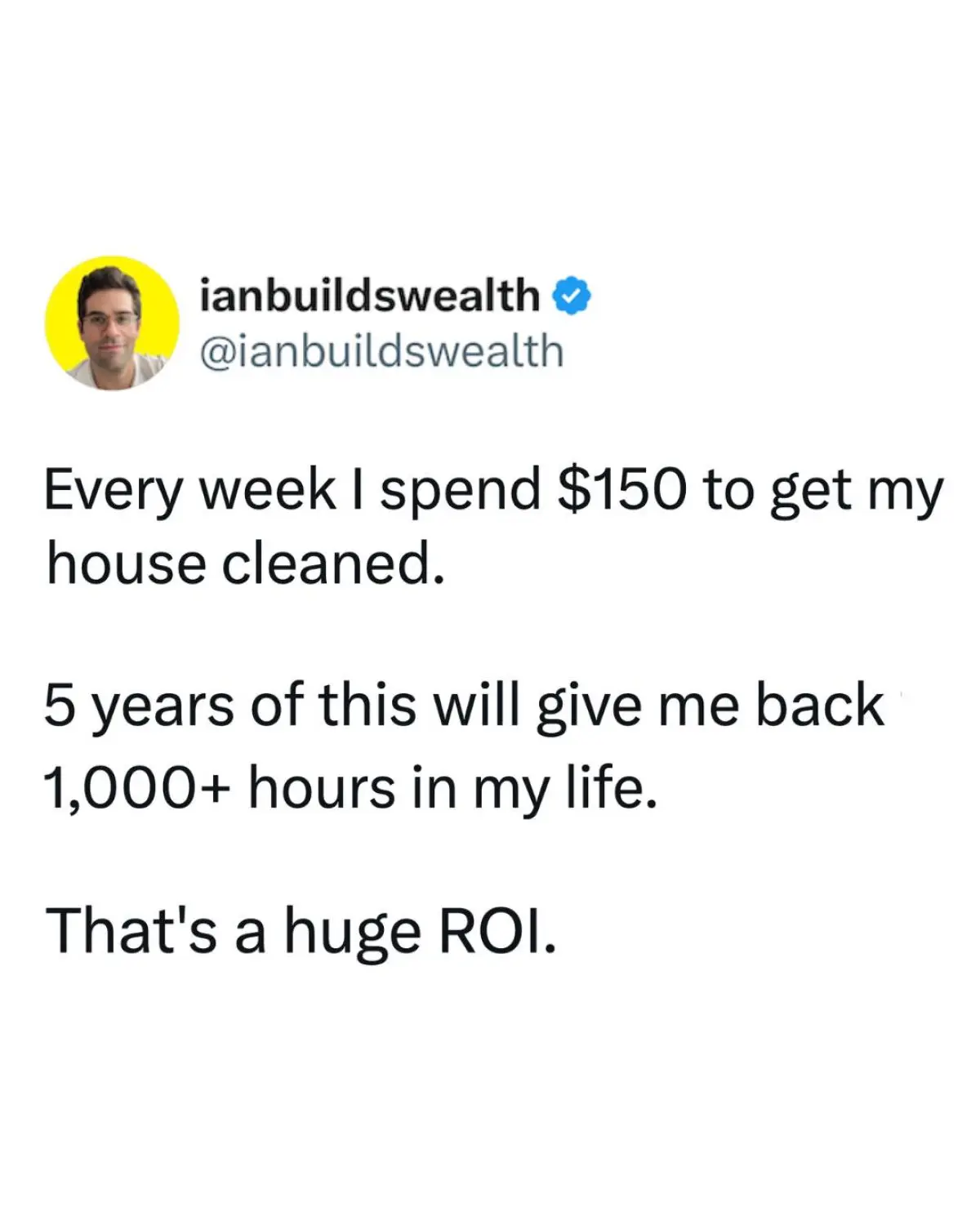

Image: Instagram

Ian Builds Wealth, known for his practical approach to money management, recently shared a candid reminder: “You can’t buy more time. But money can help you be more efficient with what you’ve got.” In his latest post, he poses a simple yet profound question to his audience—what is one purchase that brings a great return to your life? This message resonates in a world where every minute counts and financial wisdom is key to overcoming everyday time constraints.

Time Efficiency In Money Management

In today’s fast-paced environment, managing time effectively is as valuable as a prime investment opportunity. Ian Builds Wealth emphasizes that while time itself is non-renewable, strategic spending on tools, technologies, or services can enhance productivity significantly. His philosophy is that by investing in the right resources, you not only save hours in the day but also create more opportunities to build wealth. This idea isn’t new in the financial commentary world yet continues to inspire people from all walks of life. As he puts it, money is the tool that helps us stretch our available time, making every moment count.

Drawing on his years of experience, Ian explains that this isn’t a call to frivolous spending but rather a call for efficiency. Whether it’s investing in a high-quality calendar app, time-management software, or even a professional service to streamline tasks, every dollar spent can yield indirect returns in saved time. The underlying message is simple: when you optimize how you work and live, you free up more time to invest in future opportunities.

Free Training Announcement

In a move that has sparked considerable interest online, Ian announced a new free training session scheduled for next week. This training is designed to teach participants how he manages to save thousands of dollars each month. Interested followers are encouraged to join his email list to receive the first announcement. The call-to-action is clear: comment with the word TRAINING if you are ready to learn techniques that convert money into measurable time savings.

This announcement is not just about learning budgeting tips; it underscores a broader narrative—a journey towards financial freedom through informed decision-making. Ian’s free training builds on similar themes he has addressed in past posts. In one memorable message, he highlighted the assumption that social security might not be enough for retirees, urging audiences to take proactive steps rather than relying on uncertain future benefits.

Investing Strategies For Lifelong Wealth

Over time, Ian has become synonymous with practical and educational content that tackles common financial challenges. His Instagram posts delve into a range of topics from the pitfalls of living paycheck to paycheck—even among high-earning millennials—to the importance of investing in long-term assets like index funds. One of his previous posts discussed how even those who earn over $100K can end up on a seemingly endless hamster wheel of expenses, a scenario that many can identify with. This current discourse on time efficiency fits perfectly into his broader mission: to provide clear, actionable strategies that empower individuals to regain control over their finances and, ultimately, their lives.

The principles Ian shares are rooted in everyday realities. He often notes that small, regular investments coupled with a purposeful spending strategy can lead to magnificent results over time. This aligns with the idea that compounding returns, both in financial terms and in saved time, can work wonders. For instance, investing modest amounts in tools that save time today can compound into significant savings down the road. His message is underscored by a pragmatic view—that while there is no magic formula to amass wealth overnight, consistency and smart spending can bring about lasting change.

Additionally, Ian touches upon the balance between present enjoyment and future security. His candid posts remind followers that while it’s important to enjoy the moment, ensuring that money is working for you in the background is crucial. This balanced perspective is evident through his various calls-to-action, whether it’s joining his email list for free training or commenting on his posts to receive additional resources like a budgeting analyzer or an investment guide.

As the conversation around money management evolves, experts like Ian Builds Wealth continue to shine a light on the practical ways in which efficient spending not only conserves time but also builds a robust financial foundation. His transparent approach, backed by a wealth of experience, makes his advice accessible to both beginners and seasoned investors alike.

By focusing on both the immediate benefits of time-saving purchases and the long-term gains from strategic investing, Ian’s message is one of empowerment. This isn’t just another investment tip; it’s a reminder to look at our lives holistically—to see how every decision, even on the smallest dollar, can contribute to a richer, more efficient future.

The discussion sparked by his post invites readers to reflect on their own purchasing decisions and to consider how these choices might play a role in their broader financial strategy. In a digital era where every second counts, the narrative of using money to buy back time is more relevant than ever.

Read full bio of Vidya Tadapatri