7 Signs Of Unresolved Money Trauma

Discover how unresolved money trauma may be holding you back and learn actionable steps to heal now.

Image: Instagram

Joe Maddux, a respected FI/RE guide known for his candid financial insights on social media, has sparked an important conversation about the hidden emotional baggage many carry with money. In a recent post, Joe outlines seven clear signs that you may be dealing with unresolved money trauma—a condition where past memories and limiting beliefs overshadow your financial decisions. Money, as Joe reminds us, is far more than just math; it’s deeply intertwined with our personal histories and emotions.

Understanding Money Trauma

From an early age, many of us hear phrases like “we can’t afford that,” shaping our beliefs about spending and saving. Joe Maddux explains that these ingrained narratives resurface in our adult lives, creating a cycle of anxiety and self-doubt around money. The post lists seven signs that might indicate you’re carrying unresolved money trauma:

1️⃣ Panic when spending, even on things you need or want.

2️⃣ Avoiding financial statements because it feels easier not to know.

3️⃣ Feeling constant guilt about your income, regardless of how much you earn.

4️⃣ Being haunted by early lessons of scarcity, such as the recurring phrase “we can’t afford that.”

5️⃣ Hoarding money for security rather than investing in your life.

6️⃣ Freezing when faced with financial decisions.

7️⃣ Constantly comparing yourself to others and feeling like you fall short financially.

Each point reflects a behavior that might look like a simple financial quirk at first but could be symptomatic of a deeper, unresolved emotional issue. Joe’s message is clear: if these signs sound familiar, you are not broken. Instead, you might be carrying an outdated money story—a narrative that no longer serves you.

The Emotional Weight Of Money

Many individuals who have experienced significant financial shifts—even those who have doubled or tripled their incomes—find that more money doesn’t automatically translate to happiness. One of Joe’s earlier posts resonated strongly with his audience, where he shared his own experience of feeling perpetually anxious despite enjoying a six-figure salary, new cars, and luxurious homes. It’s a stark reminder that financial success on paper does not necessarily equate to emotional well-being.

This inner conflict is not unique. Millennials, professionals, and even seasoned investors are beginning to recognize that our financial mindset plays a crucial role in our overall quality of life. Joe’s observations highlight the importance of addressing the emotional roots of money decisions—a conversation that is gradually gaining traction in personal finance discussions.

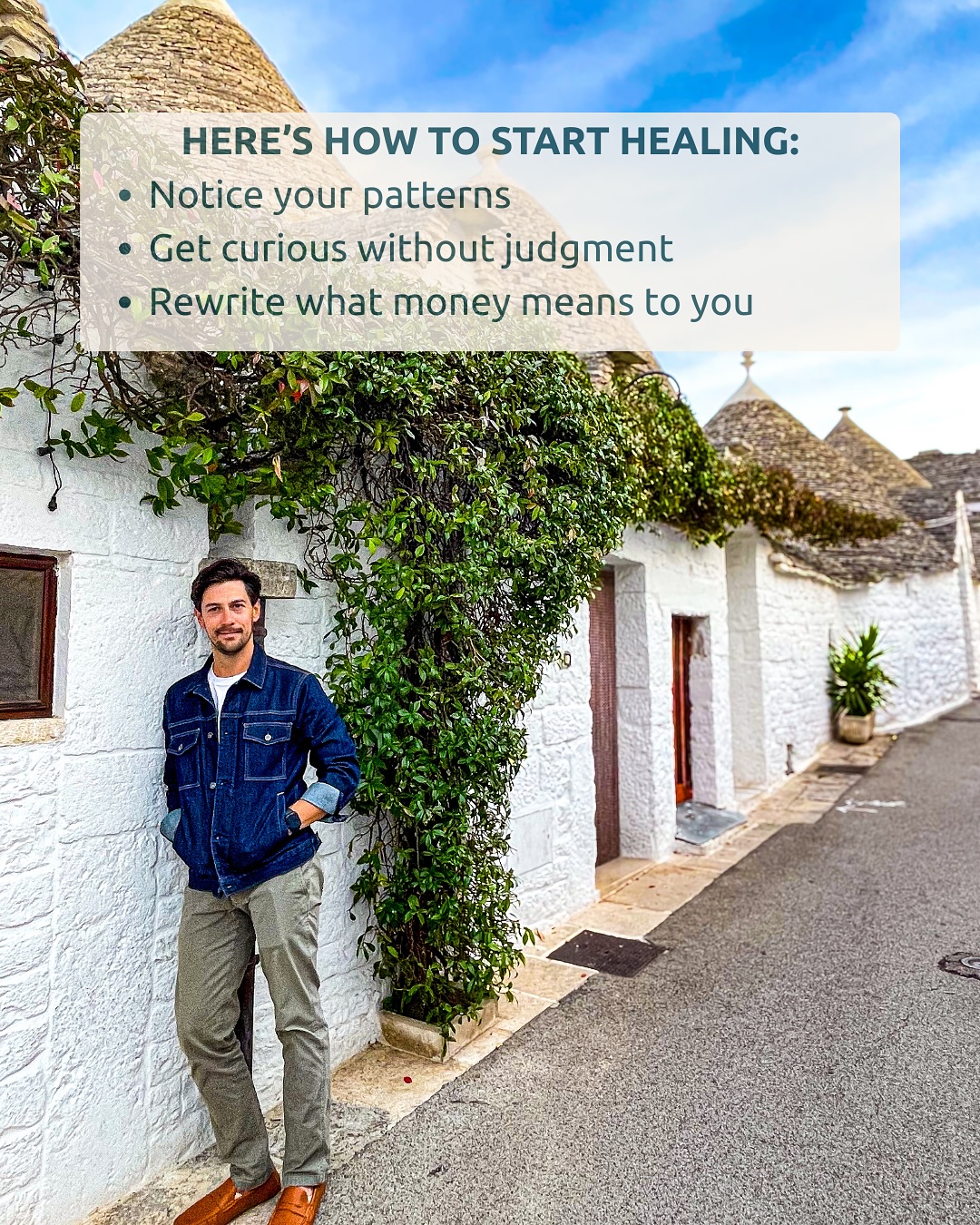

Actionable Steps To Heal

Joe doesn’t just point out the problem; he also provides a roadmap for healing these emotional wounds. He suggests a simple three-step approach that can help anyone break free from the restrictive money beliefs that hold them back:

✅ Name it: Recognize and identify the recurring negative pattern without self-judgment.

✅ Get curious: Delve into your past and ask yourself, “Where did I learn these beliefs?”

✅ Rewrite it: Actively choose a new, empowering belief that aligns with the future you want to create.

By following these steps, Joe encourages his followers to take small, manageable actions toward emotional healing. He stresses that while the process takes time, it is entirely possible to rewrite your money story. His open invitation to connect through direct messages shows his commitment to supporting those ready to embark on this transformative journey.

Real Stories And Community Insights

Many in Joe’s community have found solace in his candid approach. One of his earlier Instagram posts detailed how even after achieving significant financial gains, the familiar pangs of fear and guilt would resurface, much like an echo from the past. This resonates deeply with his audience, who often share similar experiences of feeling trapped in a cycle of anxiety, no matter how successful they become.

Other community members have echoed Joe’s insights, emphasizing that the real promise of financial independence isn’t simply about accumulating wealth—it’s about achieving a sense of peace and control over one’s life. His emphasis on intention and self-compassion serves as a guiding light for those working toward both financial and emotional freedom.

What makes Joe’s methodology stand out is its human touch. Rather than offering a one-size-fits-all solution, he acknowledges that healing is an individualized process. The key lies in awareness—understanding that your financial habits are a reflection of your past—and then taking deliberate steps to shift that narrative. His advice strikes a balance between practical money management and deeper emotional work, reminding us that true financial freedom encompasses both wealth and well-being.

This message comes at a time when many are rethinking the conventional wisdom around budgeting and saving. Instead of simply cutting expenses or obsessively tracking dollars, Joe advocates for a more holistic approach that addresses the emotional core of financial stress. It’s a welcome perspective in a landscape where many feel overwhelmed by the pressure to constantly perform and accumulate.

By inviting us to confront our fears and rewrite our internal scripts, Joe Maddux not only offers a pathway to better money management but also a chance to rediscover our self-worth. His approach is a powerful reminder that when we change the story we tell ourselves about money, we pave the way for a life of true abundance—both in our bank accounts and in our hearts.

In the end, Joe’s message is one of hope. Healing money trauma isn’t about erasing the past; it’s about transforming it into a foundation for a more empowered future. If you’ve ever felt burdened by your financial history, know that a better narrative is within reach. The first step is simply to start the conversation and take control of your money story.

Read full bio of Srijita De