Spend Better, Not Less: Intentional Wealth-Building Choices

Invest in wellness and experiences; spend intentionally for lasting financial freedom-now!

Image: Instagram

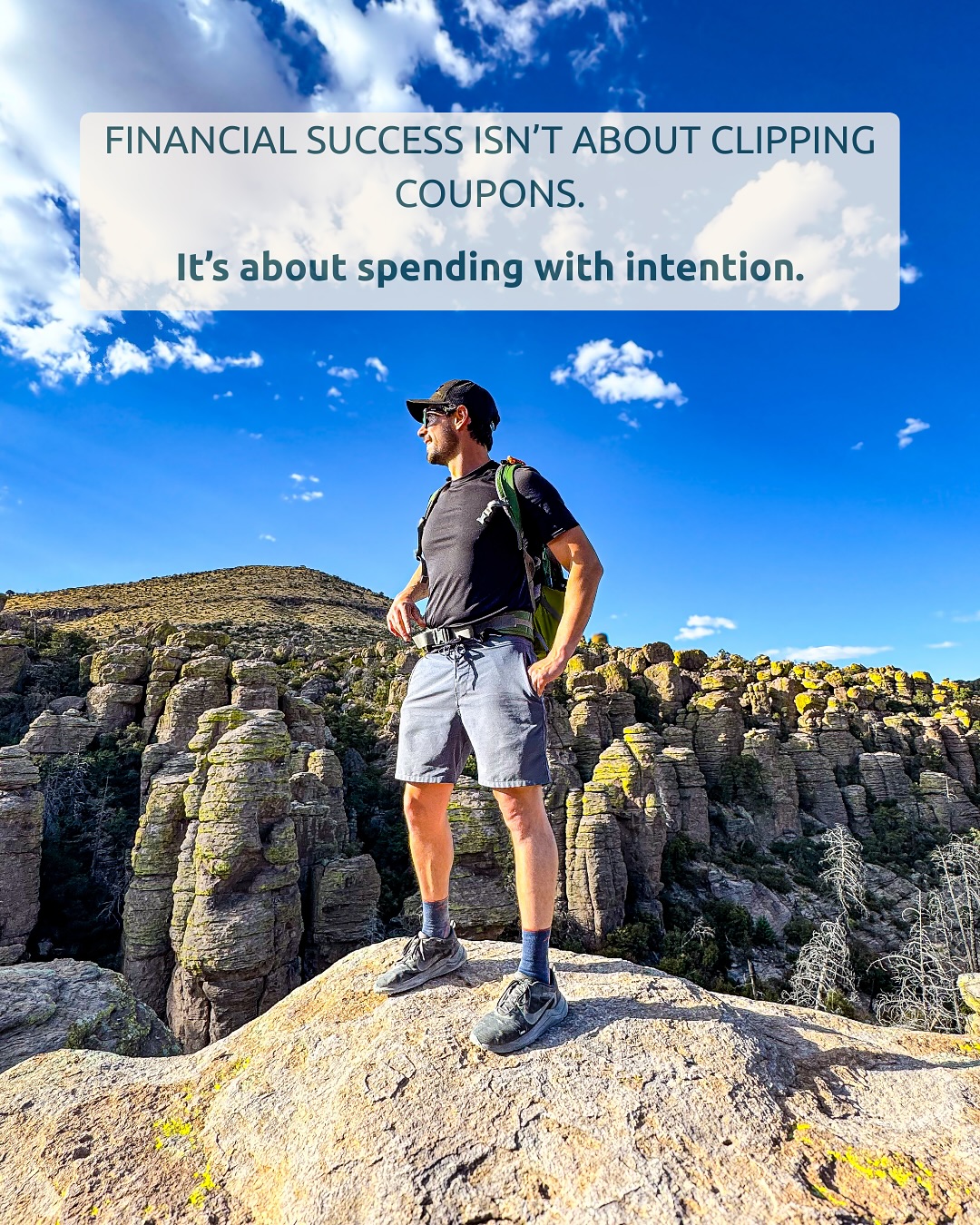

Joe Maddux, widely recognized as a FI/RE guide and financial mindset coach, is challenging the stereotype of a frugal retiree. Instead of scrimping on every little indulgence in the name of early retirement, Maddux advocates spending in line with personal values and investing in experiences that enrich one’s life. His philosophy is simple: you don’t have to be cheap to build wealth; you only need to be intentional.

Intentional Spending As A Wealth-building Strategy

In a popular Instagram post that has since resonated with audiences far beyond the personal finance community, Joe Maddux outlined his blueprint for a life of financial independence. He explained that early retirement does not require skipping all the pleasures in life. Critics often assume that to retire early, one must forgo daily lattes, clip coupons, and squeeze every ounce of frugality. However, according to Maddux, that approach is neither sustainable nor true to the idea of living life on purpose.

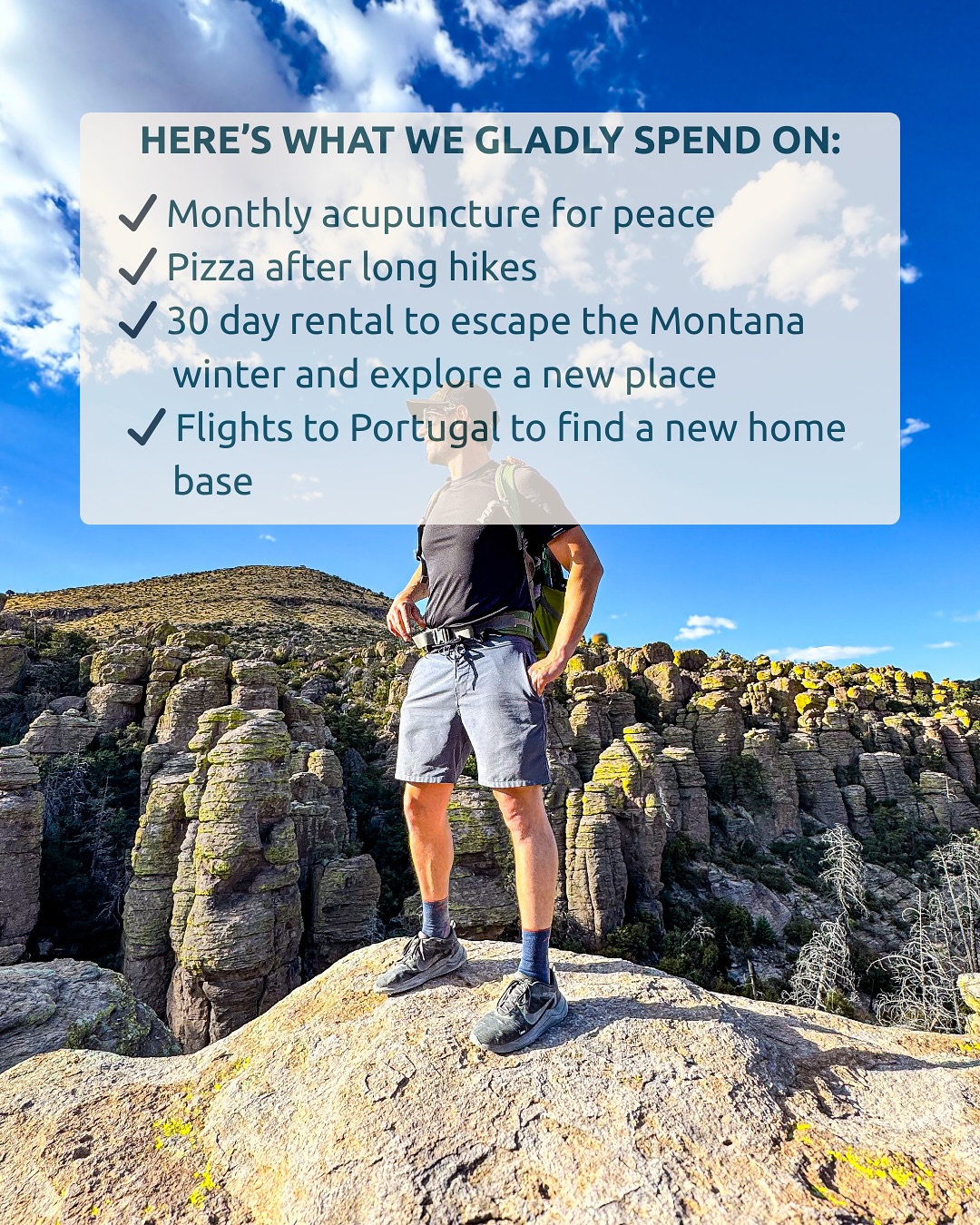

Maddux’s post paints a vivid picture of what intentional spending might look like for someone who truly values both financial freedom and quality of life. Among the investment choices he mentioned are monthly acupuncture sessions for stress relief and nervous system balance, enjoying a $40 pizza at a mountain pub after a long hike, and even booking flights to Portugal to establish a new home base. These choices, while not necessarily inexpensive, reflect a commitment to wellness, adventure, and flexibility—key elements that, he argues, contribute to a fulfilling life.

Wellness And Experiences Matter

The core message is that it isn’t about spending less; it’s about spending better. For Joe Maddux, the goal is not to eliminate expenses but to avoid spending money on things that do not add substantial value to life. He underscores the importance of prioritizing expenditures that nurture personal growth and freedom. Designer brands, daily delivery apps, and random impulse purchases are on his list of items to skip—unless they align with what truly matters.

Maddux’s approach is a stark departure from the typical austerity narrative attached to early retirement or financial independence. By emphasizing the idea of spending intentionally, he encourages his followers to invest in experiences rather than accumulating “stuff.” He is quick to note that the goal of financial freedom is not an endless pursuit of more money, but rather the acquisition of peace, flexibility, and time freedom.

Drawing on his two decades in journalism and his deep understanding of lifestyle trends, it’s clear that Joe Maddux’s message is resonating with a generation that values balance over sacrifice. His message is simple yet radical: live your life in a way that reflects your true values, invest in yourself, and let your money work for a richer, more fulfilling lifestyle.

Recent discussions in related social media posts further emphasize the importance of intentional financial planning. In earlier posts, Joe also explored themes such as money trauma, financial anxiety, and the importance of automating finances to reduce daily stress. These supplementary narratives create a broader context, showing that the journey to wealth is as much about emotional alignment as it is about numerical growth. Viewers and readers alike are encouraged to reflect on their own spending habits with a critical eye and are even offered practical steps to rewrite old money stories.

For example, one of his earlier Instagram posts delved into identifying unresolved money trauma. It shared seven signs of financial anxiety such as panic when spending and overwhelming guilt despite high earnings. The post suggested that awareness and compassion were the first steps to healing those ingrained money habits. In another insightful post, Joe detailed a step-by-step system to prioritize different types of investment accounts—from maximizing an employer’s 401(k) match to strategically using taxable brokerage accounts for early retirement. Together, these threads form a coherent message that intentionality is key to aligning one’s spending with one’s life goals.

Joe Maddux’s perspective challenges conventional norms on both sides of the financial equation. Instead of being locked into the idea of pinching pennies to accumulate wealth, his message opens up a conversation about spending wisely. He shows that even indulgent experiences, when chosen deliberately, can contribute to a sense of well-being and long-term financial stability. His approach is a refreshing divergence from the minimalist dogma that has long dominated financial independence discourse.

The emphasis is never on deprivation. Rather, it’s on creating a budget and lifestyle that invest in experiences, health, and overall happiness. With each thoughtful purchase or investment in personal well-being, the philosophy becomes clear: financial freedom is not a life of limiting yourself but rather a life of making every dollar count toward what truly matters.

In a world where many equate wealth with restraint and sacrifice, Joe Maddux’s intentionally expansive approach offers a balanced alternative—a way to be both prosperous and genuinely content.

Ultimately, his advice is a call to action: comment “ALIGN” if you’re working on building a life that reflects what you truly value. It’s a reminder that your financial choices should mirror the richness of your life, not diminish it.

Read full bio of Srijita De