Real Joy Trumps Retail Therapy For Financial Freedom

Embrace simple pleasures that boost well-being and free your cash from cost traps today?!

Image: Instagram

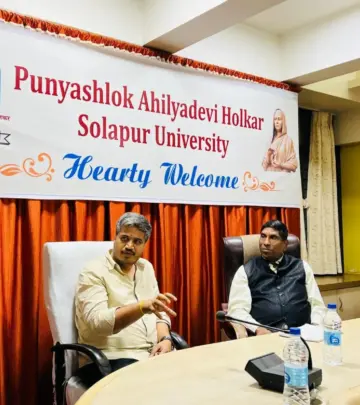

In a world obsessed with buying and spending, a growing number of individuals are discovering that the key to true happiness doesn’t reside on the price tag. Ian Group, known for his practical money and investing insights under the handle @ianbuildswealth, reminds us that sometimes the best things in life come free.

The True Value Of Simple Moments

“You don’t have to spend money to feel better,” reads the succinct message in the latest post by Ian Group. The statement is a refreshing call to reexamine our purchasing habits. Often, we reach for our wallets in an effort to fill an emotional gap, only to find that a pause—whether in the form of a gentle walk outside, a heartfelt phone call, or cooking dinner with loved ones—brings far more fulfillment. This message adheres to a growing trend in financial literacy that values experience and connection over material accumulation.

Everyday moments, as emphasized by Ian Group, can be the building blocks of a life that is both meaningful and financially free. In contrast to retail therapy, which might provide a fleeting high, genuine joy stems from the simplicity of everyday life. The post not only challenges the assumption that more money or expensive purchases equate to happiness but also encourages a more sustainable approach to living. It’s an invitation to pause, reflect, and rechannel energy into activities that nourish both the soul and the bank account.

Rethinking Retail Therapy

The concept of retail therapy has been a popular, yet often misguided, cultural phenomenon. While the brief satisfaction of buying a new item may serve as a temporary distraction, its benefits are ephemeral. Ian Group’s post thoughtfully contrasts this by illustrating that a leisurely walk or spending quality time with family offers a richer, enduring sense of well-being. His words echo the advice seen in previous posts such as “You can’t buy more time,” creating a narrative that questions whether spending on possessions can ever substitute for the intangible rewards of life experiences.

The idea that money cannot purchase true happiness is not new, yet it resonates deeply in the current climate of high living costs and financial uncertainty. This is further reinforced by additional insights from related content, where practical budgeting tips and investment strategies are shared. In these posts, Ian Group underlines the importance of managing expenses wisely—reminding followers that every dollar saved is a step toward long-term financial security.

Tips For A Budget-friendly Life

Beyond the inspirational prompt to seek joy without spending, Ian Group’s community is frequently treated to actionable advice on how to achieve financial stability. One post notably asks, “What’s something you buy that has a great return for you?” This not only sparks dialogue but also invites people to reframe their spending in terms of value and return on investment. Essentially, not all spending is created equal; the real challenge lies in distinguishing between impulsive purchases and investments in experiences that truly enrich our lives.

Moreover, the underlying message is a call to embrace a lifestyle that values efficiency. When money is spent thoughtfully, it works harder in building a future that is not only secure but also vibrant. A subtle nod to the realities of modern life is evident in discussions about debt management, saving strategies, and even the predictive musings on future costs shared in earlier posts. Ian Group’s approach connects the dots between restrained spending and enhanced quality of life.

Building Wealth Without Excess Spend

While the idea of living without excess spending might appear strict at first glance, it actually champions a mindful reordering of priorities. Instead of succumbing to the temporary highs of consumer culture, one is encouraged to invest in social connections and personal growth. A phone call with a friend, a brisk walk in the fresh air, or a home-cooked meal with family can serve as potent antidotes to the flashiness of modern consumption.

This reimagined lifestyle, as promoted by Ian Group, places value on self-care and long-term satisfaction. By focusing on experiences that have lasting benefits rather than immediate gratification, individuals can build a strong foundation for both emotional and financial well-being. It’s a simple yet profound strategy: spend less on fleeting pleasures and invest more in moments that nurture the spirit.

In the end, the narrative crafted by Ian Group is as practical as it is inspiring. It calls upon readers to reexamine their spending habits and to embrace the everyday joys that add true value to life. His guidance is not merely a rejection of retail therapy but an endorsement of a more balanced and sustainable approach to financial freedom.

By turning away from habitual spending and towards the richness of life’s simple offerings, individuals can align their finances with a lifestyle that is both rewarding and secure. This message is particularly timely in today’s economic landscape, where smart money management can pave the way for a stress-free future.

Ian Group’s advice is a gentle yet powerful reminder that financial empowerment often begins with small changes, and sometimes those changes are as uncomplicated as taking a moment to breathe and enjoy the beauty of everyday life.

Read full bio of Vidya Tadapatri