Plan Your Financial Future With Strategic Wealth Goals

Mapping Your Path: From Debt Dilemmas to Investment Wins with a Clear Financial Plan ASAP!

Image: Instagram

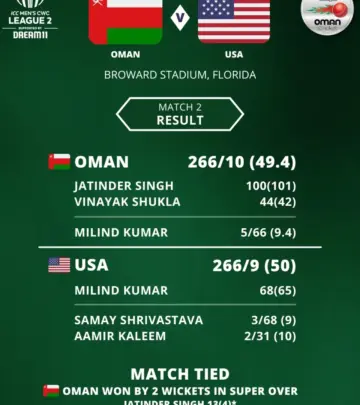

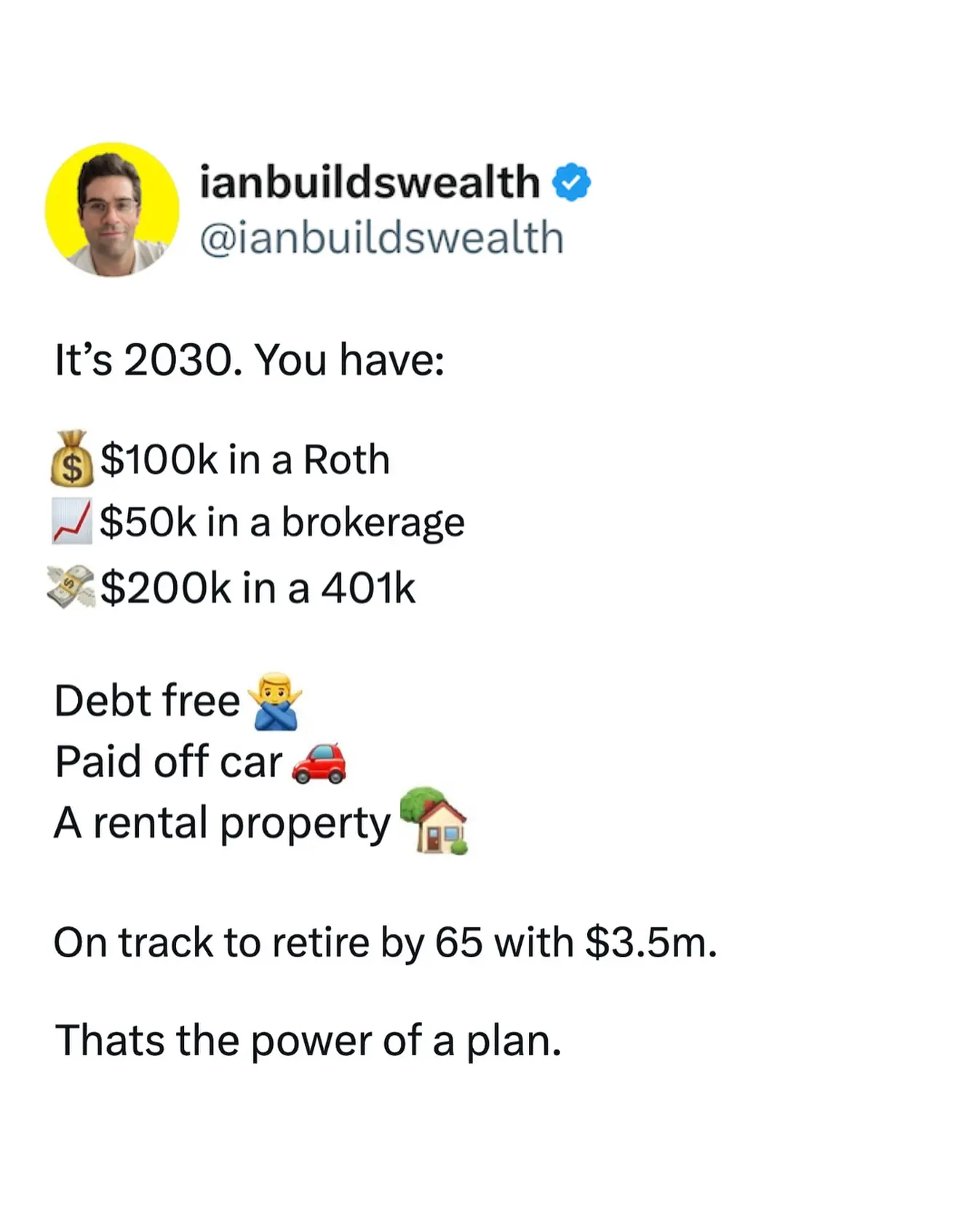

In today’s fast-paced financial landscape, the dream of becoming debt-free, owning a rental property, and growing a six-figure investment portfolio is closer than you might think. Ian Group | Money & Investing, known as Ian Builds Wealth on Instagram, recently reminded his followers that achieving these milestones isn’t about having every answer right now—it’s about having a plan.

A Clear Financial Vision

Imagine a future where debt is a thing of the past, where your rental properties generate steady cash flow, and where your investment accounts steadily climb into six figures. According to Ian, the vision of retiring with $3.5 million, although ambitious, can become a reality with a focused strategy. At the heart of his message is the reassurance that the journey toward financial freedom does not require you to have every detail resolved today. Instead, simply establishing a clear financial plan can be the catalyst for monumental change.

Many individuals find themselves trapped in the cycle of debt, uncertain about how to start investing, and worried that they’ll never make enough. Ian’s recent post strips away the complexity by asking a straightforward question: What’s the one financial goal you want to achieve this year? This call-to-action resonates on multiple levels, challenging his audience to break free from financial stagnation and to take action by mapping out their next steps toward wealth building.

Turning Financial Challenges Into Opportunities

The Instagram caption highlights a duality that many face: the contrast between present financial stress and the potential of a better financial future. While some may be plagued by feelings of being stuck in debt, others might be unsure of where to begin their investment journey. Ian’s approach is refreshingly pragmatic. He emphasizes that the key to success is not having all the answers immediately, but rather, having the willingness to develop and follow a structured plan.

Drawing on his wealth of experience in the digital space, Ian touches on the necessity of education when it comes to investing. As he frequently reminds his followers, every investment carries risk, and the past performance of any asset or strategy is not a guarantee of future success. His content remains purely educational, urging everyone to do their own research and consider professional advice before making decisions. This clear disclaimer helps to maintain transparency and credibility.

Real-life Reflections And Practical Tips

A look through Ian’s previous Instagram posts reveals a consistent theme: budgeting, mindfulness, and planning are crucial. In one post, he narrates an anecdote about reading a book that shifted his perspective on financial hardships. He recalls that even when burdened by debt after graduating, he could look back and recognize the hidden value in his struggles. In another post, he stresses that spending money isn’t always the answer—instead, sometimes a pause to reassess spending habits, like opting for fresh air or quality time with loved ones, can offer more sustainable joy. These real-life reflections resonate with anyone who has ever felt overwhelmed by financial challenges.

Furthermore, Ian’s message extends beyond just debt and investment. In a creative twist, he prompts his followers to consider the concept of opportunity cost. One post emphasizes that while you can’t buy back lost time, investing wisely can exponentially benefit the time you have. Even a small monthly contribution, when compounded over time, can significantly impact your financial freedom. He encourages community engagement by asking his audience to drop comments and share their personal financial goals—a move that not only builds connection but also fosters a sense of shared purpose.

Building A Strategy For Long-term Success

At the core of Ian’s advice is the idea that financial prosperity is not an instantaneous reward, but rather the outcome of consistent, incremental actions. Whether it’s paying off debt or starting an investment account, each step, however small, paves the way toward larger financial goals. His clear call to action—ask yourself what financial goal you want to achieve this year—serves as a reminder that every journey begins with a single, conscious decision to change.

Ian’s hands-on approach is further reflected in his commitment to sharing practical tools for wealth building, such as budgeting analyzers, free training sessions, and guides for saving on monthly expenses. By demystifying complex financial concepts, he empowers a diverse audience—from young professionals to those well into their careers—to take control of their financial destinies.

In a world where economic uncertainty is common, the message is clear: financial freedom is within reach if you are prepared to craft a plan and take deliberate action. Ian Builds Wealth continues to inspire his followers by providing tangible steps, relatable insights, and the encouragement needed to shift from financial struggle to financial empowerment. His consistent emphasis on planning, combined with an honest acknowledgment of the challenges people face, makes his advice particularly compelling.

In essence, while the pathway out of debt and into substantial wealth might seem daunting, it is accessible with a clear strategy and persistent effort. Every financial decision made today lays the groundwork for a more secure tomorrow, and the journey towards financial freedom begins with one definitive step: making a plan.

Read full bio of Vidya Tadapatri