High Earners Face Rising Costs

High earners wrestle with soaring costs as even six-figure incomes stretch every dollar.!!

Image: Instagram

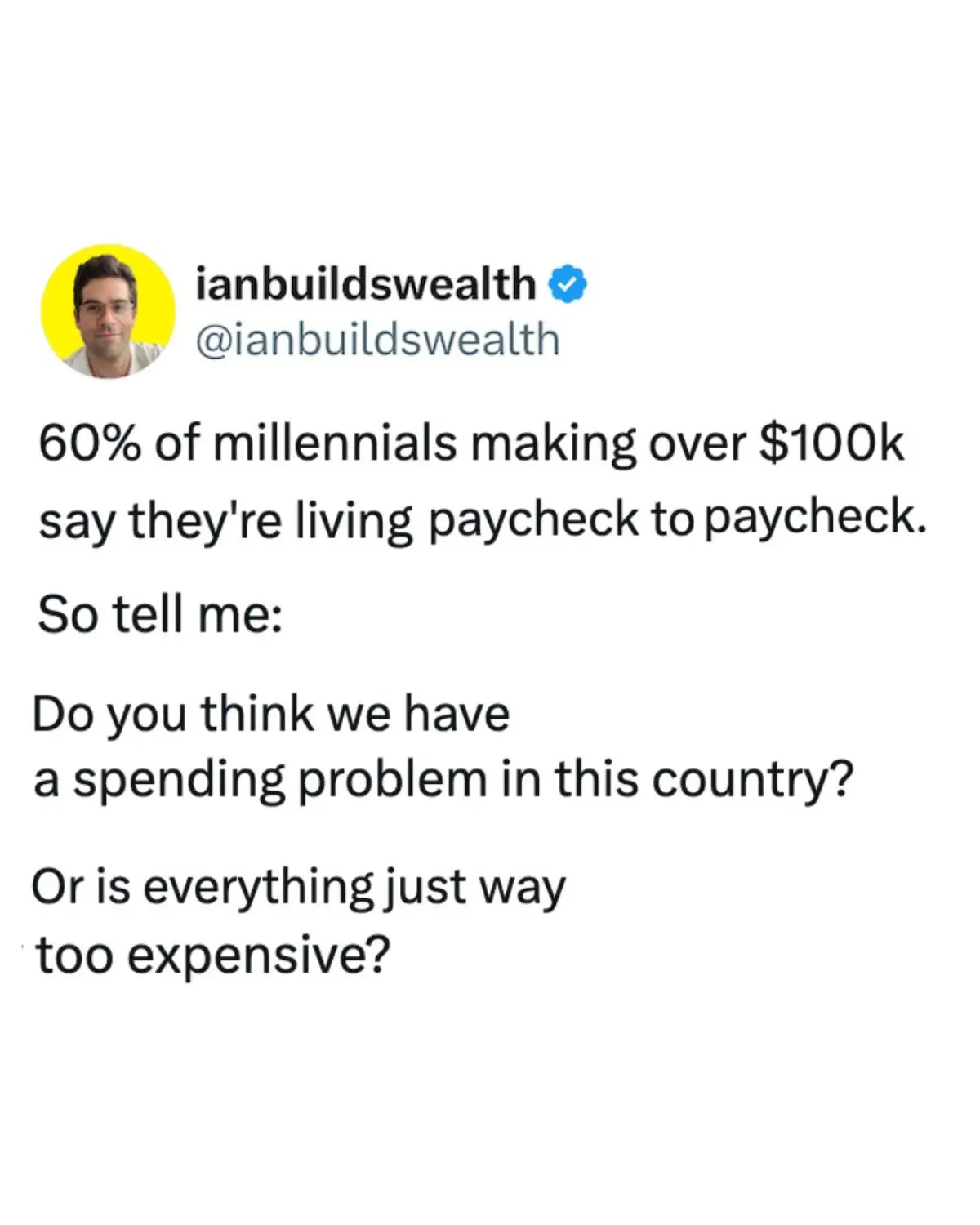

In an era when a six‐figure salary is often considered a ticket to financial freedom, a startling statistic is challenging that notion. A recent post by Ian Group, a respected voice in money and investing circles, revealed that 60% of millennials earning over $100k are, in fact, living paycheck to paycheck. The message is clear: even high earners can find themselves trapped on a financial hamster wheel.

Financial Reality Check

The post poses a question that many in the high-income bracket may find unsettling: “Ever feel like no matter how much you earn, you’re still stuck on the hamster wheel?” According to data shared by Ian Group, many millennials, despite earning impressive incomes, face the harsh reality of rising living costs. Rent skyrocketing, healthcare expenses consuming a substantial portion of paychecks, and other essential expenditures have turned what once seemed like a cushy salary into a tight balancing act. Ian Group challenges his audience to consider whether these financial strains are due solely to personal spending habits or if they reflect deeper systemic issues where basic living costs have spiraled out of control.

Budgeting remains a cornerstone of financial planning, yet the post warns that no amount of trimming daily expenses—like forgoing that extra latte—can compensate for rapidly increasing rents or the high costs of quality healthcare. The underlying message is both a wake-up call and an invitation for a broader conversation on affordability and financial sustainability in today’s economy.

Budgeting Challenges In A High-income World

The discussion isn’t just about micromanaging expenses. It points toward a more complex scenario where individuals with seemingly secure finances are forced to scrutinize every expense. As one reads the post, the reality sets in: even with a high income, the cost of living has outpaced earnings for many. This isn’t merely a case of poor budgeting; it is a reflection of an increasingly expensive society.

Several related posts from Ian Group further underscore these challenges. One earlier Instagram update vividly described how growing older brings escalating expenses, even for those with ample incomes. In that post, he mentioned, “Not everyone will do this. Let me take out my crystal ball for a second… As we age, life will get more expensive.” Such commentary resonates with the current discussion, pointing toward the inevitability of rising costs—whether it be for weddings, homes, or healthcare.

Another notable post encouraged followers to rethink budgeting strategies. It asked, “Can you work this into your budget?” and offered practical advice on managing debt and tracking monthly expenses. This evidence suggests that while individual financial literacy is essential, external economic pressures are blurring the lines between personal spending and systemic affordability issues.

A key element in these discussions is the debate between attributing financial strain to personal spending habits versus structural economic challenges. Many high earners find that despite making adjustments and cutting non-essentials, their monthly budgets remain strained. This has sparked a broader conversation online about the affordability crisis. Is the issue simply that individuals are overspending on luxuries, or are the underlying economic conditions so challenging that even disciplined budgeting is not enough?

Ian Group’s content often emphasizes that budgeting, while critical, isn’t a cure-all. His characteristic style of combining personal anecdotes with data-driven insights provides a nuanced view of financial challenges today. He notes that while small savings can add up over time, they cannot entirely mitigate the impact of dramatically increased fixed costs, such as rent that has nearly doubled in many urban areas.

This conversation echoes a broader trend seen among millennials who are increasingly vocal about their financial struggles despite impressive incomes. The notion that success is defined solely by a high salary is being re-examined as many find that their lifestyle demands and economic realities force them to live in a constant cycle of income and expense.

The current financial reality for high earners is a multifaceted issue. On one hand, there is an undeniable truth in the data: a significant percentage of millennials with six-figure incomes are not saving as much as they should and are operating on thin margins. On the other hand, the conversation opens up deeper questions about the broader economic system and the pressures it places on individuals. With rising healthcare costs, surging rents, and an ever-increasing price tag on everyday necessities, it appears that even sound financial planning can fall short in the face of relentless economic pressure.

Financial experts urge not only better personal budgeting practices but also systemic reforms to address these soaring costs. For many, the takeaway is clear: cultivating financial resilience is now more important than ever, and part of that resilience involves advocating for economic policies that make basic living expenses more affordable.

Ultimately, Ian Group’s candid discussion serves as both a caution and a call to action for high earners everywhere. It challenges the long-held belief that a high income guarantees financial freedom and invites a broader dialogue on what it really means to be financially secure in today’s world.

The debate continues online, and readers are encouraged to share their thoughts. Are these financial strains a result of personal spending habits, or is there a systemic affordability crisis at play? As the conversation evolves, it’s clear that solutions will require both individual effort and substantial policy shifts.

Despite the challenges, the message remains hopeful. With increased financial literacy and strategic planning, millennials and high earners can work to break the cycle and forge a path toward long-term stability, even in an economy marked by rising costs.

Read full bio of Vidya Tadapatri